04 Feb The Durbin Amendment

What it is:

An amendment proposed by Senator Richard Durbin of Illinois, which took effect October 1st, 2011. The Durbin Amendment impacts debit Interchange fees, which is the rate structure set by Visa & Mastercard, also known as “true cost.” This amendment changes the Interchange cost of debit card transactions to 5 basis points (.05%) charged against the total amount of a transaction plus an additional $.22 per transaction. While the intent of the amendment was aimed at protecting merchants and their customers, the law is having some likely unintended consequences.

Which merchants benefit from Durbin?

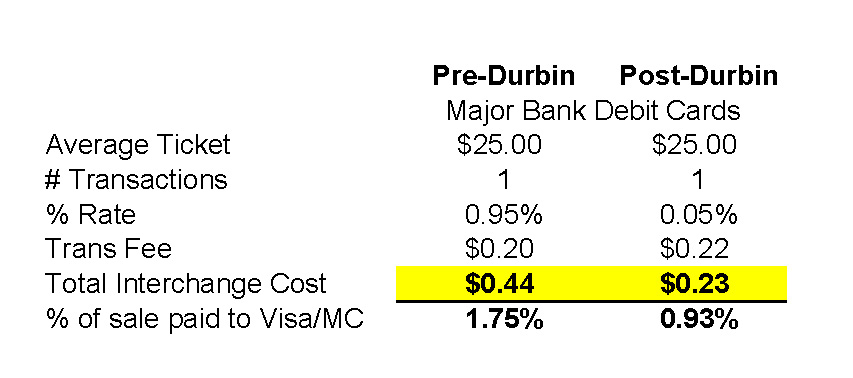

Business owners who have an average ticket greater than $12.00 and are set up on an Interchange pricing model with the processing bank will benefit from the Durbin Amendment. The example below is for a merchant with an average ticket of $25 comparing pre- and post-Durbin pricing. In this example of a $25 average ticket, there is a net $.21 savings per transaction. As your transaction amount increases, so do the savings compared to the previous rate structure:

Who else benefits from Durbin?

Who else benefits from Durbin?

Visa & Mastercard benefit from an Interchange rate that has increased by an average of 1% on businesses whose average ticket is under $12.00. Additionally, banks, processors, and agents who offer tiered pricing models (Qualified, Mid-Qualified, & Non-Qualified rate tiers) have seen an increase in their profit margin over night. Though this profit margin was meant to be received by the business owner as savings, the Durbin Amendment does not provide regulation that requires banks to pass on potential savings.

Which merchants are negatively affected by Durbin?

If your business is set up with a form of tiered pricing, you will most likely not see any benefit from this amendment. Additionally, if your average ticket is lower than $12.00, (even if you are set up with Interchange pricing) you will pay considerably more to Visa & Mastercard than before. Previously there was a small ticket interchange category for major bank debit cards which had helped moderate transaction costs for small ticket merchants. This category has been effectively eliminated under the Durbin Amendment. Lets look at a a pre- and post-Durbin debit card transaction scenario for a merchant where the average ticket is $7.00:

In this scenario, we see that there is an additional $.07 cost on a $7 transaction now that the Durbin Amendment has been enacted compared to the previous small ticket pricing. That might not seem like a lot on the surface, but let’s look at how the cost jumps with additional transactions:

In this scenario, we see that there is an additional $.07 cost on a $7 transaction now that the Durbin Amendment has been enacted compared to the previous small ticket pricing. That might not seem like a lot on the surface, but let’s look at how the cost jumps with additional transactions:

With only 1000 transactions per month (not many for your standard coffee or fast food business) we see an increased cost of $75 per month. The net percentage increase in Interchange costs has jumped by a full percentage point for small ticket merchants as a result of the Durbin Amendment. If you accept debit card transactions less than $7, your cost will be even higher.

Contact us to learn more about the Durbin Amendment

Greater Detail on the Durbin Amendment

The Durbin Amendment is a provision in the larger Dodd-Frank Wall Street Reform and Consumer Protection Act signed into law on July 21st, 2010 is aimed at providing greater regulatory control over federal financial agencies. Specifically, the Durbin Amendment aims to control debit interchange fees and restrict anti-competitive practices. The law applies to banks with over $10 billion in assets (approximately 75% of all card issuing banks) and requires these banks to charge debit card interchange fees that are “reasonable and proportional to the actual cost.”

The Durbin Amendment gave the power to control these rates to the Federal Reserve, who determined that “reasonable and proportional” means 5 basis points (a $5 fee per $10,000 in debit card sales) plus an additional $.21 per transaction with an additional $.01 allowable for fraud prevention measures. Essentially, the final cost is 5 basis points and $.22 for normal debit card transactions.

One additional provision is that the Durbin Amendment allows merchants to legally refuse the use of debit cards for transactions under $10.00. While a common practice for many smaller merchants, this practice was previously technically illegal per Visa/Mastercard regulations.

The Durbin Amendment went into effect October 1st, 2011.

While the intent of the Amendment is to protect merchants and prevent unreasonable charges from being levied against them, the end result may not have the impact initially intended. The Amendment is targeted at regulating debit Interchange fees charged by Visa/Mastercard; however, there is no provision for how or even if card processors must pass these savings on to their merchant customers.

According to a recent survey of card processors, a full 59% were planning on not distributing the resulting savings to their merchants. Many others are offering up only partial savings. Merchants set up on an Interchange pricing model are the only beneficiaries of the savings offered by the Durbin Amendment. Merchants on a tiered pricing model, most often identified by the terms “qualified,” “mid-qual,” or “non-qual” on their statements, will not benefit fully from from the Durbin Amendment, and many will not benefit at all.

Tiered pricing allows processors to hide the true cost of transactions (which are clearly outlined in an Interchange model) and thereby hide the profit offered by the Durbin Amendment from their customers. A merchant on a tiered model will have no idea what their true savings would have been and rely upon the “good graces” of their processor to pass those savings on.

At AdvoCharge, all our customers are priced on an Interchange model and your costs are clear and transparent. You will receive all the savings offered by the Durbin Amendment if you are a higher ticket merchant, and if you are a smaller ticket merchant you will minimize the costs associated with the Durban Amendment. Like all AdvoCharge customers, you will save between 40-80% more than what you are paying to your current processor.

Send us one month of your current processing statement and we will show you exactly what our “Rates at Cost” program will look like for your business. You will see, in a side-by-side comparison, our rates compared to those of what will likely be your old processor, because when you learn how much you’ve been paying for the same or lower quality service, we’re sure you’ll be ready to switch!

Sorry, the comment form is closed at this time.