21 Sep The True Cost of Small Purchases

Erin Dugan

Sept 21, 2013

It’s a few minutes before work, and I’m standing in line at the coffee shop. Still blurry around the edges and stumbling through the initial thoughts of the day. Did I respond to that email? Did I remember to do that edit? Do you think anyone will notice that I forgot to match my socks again? The line is really long today. I might need to use the “traffic was really bad on 36” excuse again. There’s no need to think about what I want. It’s an iced americano and a bagel. It doesn’t matter what time of year it is, I love it iced. Any day that doesn’t start this way feels off and I stumble through the first couple of hours a little unfocused and a bit edgy.I’m snapped back to reality by the guy at the register.“How are you this morning? Getting the usual?”

Erin Dugan

Sept 21, 2013

It’s a few minutes before work, and I’m standing in line at the coffee shop. Still blurry around the edges and stumbling through the initial thoughts of the day. Did I respond to that email? Did I remember to do that edit? Do you think anyone will notice that I forgot to match my socks again? The line is really long today. I might need to use the “traffic was really bad on 36” excuse again. There’s no need to think about what I want. It’s an iced americano and a bagel. It doesn’t matter what time of year it is, I love it iced. Any day that doesn’t start this way feels off and I stumble through the first couple of hours a little unfocused and a bit edgy.I’m snapped back to reality by the guy at the register.“How are you this morning? Getting the usual?”

Nodding sleepily and letting out a slight grunt, I hand him my cup and card. The register reads $4.25. He swipes, I sign and wait at the other side of the bar to continue with my day.

The ritual is so familiar and seems so uncircumstantial, but nobody knows the true cost of these small credit card purchases like those businesses who run them all day long. Whether the shop is booming with every seat filled and a line out the door, or a few people trickle in throughout the day, the issue is the same: these small purchases add up, and in some cases cost more than the profit they bring in.

How the Durbin Amendment changed transaction cost

Before we discuss the numbers, let me explain the background a bit.

A big part of the small-ticket squeeze merchants are feeling stems from the Durbin Amendment. In October of 2011, the Durbin Amendment was passed as part of the Dodd–Frank Wall Street Reform and Consumer Protection Act with the intention of overhauling the financial regulatory system that led to the financial crisis of 2007-2010. Specifically, the Durbin Amendment was intended to control debit card Interchange fees and increase competition in payment processing options. Previously, the rate for small ticket transactions was 1.55% against volume and $.04 per transaction for what Visa consider to be small-ticket (under $12 per transaction).

The feeling was that this charge associated with debit transactions at 1.55% was disproportionately high compared to the risk associated with such a card. Since debit cards are directly tied to an individual’s checking account, a transaction will go through if the funds are there, and decline if they aren’t. Thus there is less need for risk-management charges. While the new pricing structure that was implemented through the Durbin Amendment was great for larger purchases, the pricing structure that became tied to debit card transactions through the Durbin had (likely) unintended consequences on small ticket transactions.

What does a small purchase really cost?

To get technical for a moment, the new debit card Interchange rate is .05% against the total sale and $.22 per transaction ($.21 cents plus an additional $.01 if the acquiring bank demonstrates specific security measures – effectively $.22 per transaction). Businesses who ran an average ticket amount of $12.00 and over had the potential of really benefiting from this new rate structure as the .05% was much lower than the previous debit card Interchange rate of 1.55%

However, for low average ticket businesses like coffee shops and fast food restaurants (who routinely run purchases between $5 and $7) the Durbin Amendment’s $.22 per swipe fee ended up making these small transactions very expensive. Let’s look at a pre- and post-Durbin example of a $7.00 transaction:

With only 1000 transactions per month we see an increased cost of $75 per month!

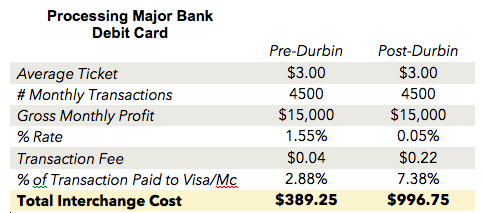

Now let’s look at what a typical coffee shop running about 150 transactions per day would be paying both pre- and post-Durbin if their average ticket was $3 per transaction:

As any business owner will tell you, paying over 7% to process a credit card is totally unacceptable, let alone for a small business working on very low margins. In our example we see that there is now a more than $600 monthly increase in overall fees! This is just the straight Interchange cost before any mark-up from agents or processors! (Thankfully for our customers, we use only interchange pricing and our monthly rate is very low) Besides the infinitely complex and volatile market of coffee trade, it’s no wonder coffee shops keep having to raise their prices! The next time you complain about an expensive latte, take a moment to notice how you’re paying for it. When you see a sign that says “please use cash to help keep prices down,” now you understand why.

These high fees have influenced many shops to require a $5-10 minimum which was technically illegal (albeit difficult to enforce) before the Durbin Amendment was passed in 2011. While Durbin at least allowed merchants to legally limit credit card acceptance, but what is largely unknown by merchants is that Durbin doesn’t allow this limitation on debit cards, only credit cards. Debit cards–the very cards that are causing the increased expense–cannot be limited.

Refusing to Accept Credit

Sometimes there is a knee-jerk reaction to credit card processing by businesses. Some businesses won’t take American Express due to their higher rates, and some go to the extreme of refusing credit cards all-together. Here in the Boulder area, one such local business even kept an IOU book with names and purchases scrawled out within its pages as to not turn down a purchase. For nearly 20 years, this business decided it was worth giving away product in hopes of settling later with cash. One can only imagine the nightmare of collecting on these disorganized IOU’s (Although sometimes bitter, baristas aren’t exactly well known for their burly, “knee cap-breaking” stature).

So why accept credit cards at all if you have to incur these higher rates? Well, there are still plenty of reasons not to shun plastic altogether that often far outweigh the long-term cost of shying away. In the scenario of my $4.25 morning ritual, the $0.22 it cost to run the card might be nominal compared to the potential loss of business from turning me away. You never know who could be your next loyal customer – the one who brings you their business and the business they generate through word-of-mouth promotion.

So how do you keep my business and the business of other bleary-eyed morning commuters who can’t cobble together the $4.25 in cash needed for their morning fix? There are options for taking a lighter hit and techniques you can employ to increase overall sales while minimiZING your credit card expenses.

If you need any guidance in implementing these techniques or have questions about the Durbin Amendment or any other issues with merchant services, AdvoCharge is here to help. We don’t charge any extra over our normal monthly fee for this information because that’s what we’re here for! We are only successful when you are successful. We look forward to hearing from you.

To your success!

Erin

———————–

If this is the first time you are hearing about us, please watch this quick video to learn how we can help you keep more of your hard-earned money.

Sorry, the comment form is closed at this time.